Latest Update:

There have been significant changes to the capital requirements and office space options for Asset Managers who wish to establish in the DIFC. The Base Capital for such licenses has been reduced to US$ 140,000, and Expense-Based Capital Minimum (EBCM) has been done away with for firms that only control (but do not hold) Client Assets. For those firms who hold Client Assets, the EBCM will be calculated as 18/52 of annual audited expenditure.

There are further capital requirement changes due in July 2026, which will introduce the concept of Activity-Based Capital Minimums.

Furthermor, the DIFC has established a dedicated Funds Centre, the region’s first dedicated ecosystem for funds, fund platforms, fund administrators and fund managers. Flexi-desk spaces in the centre start at US$ 27,000 per annum, with options of 3-4 visas. This has a significant downward impact on the costs of operations for financial service firms that engage in wealth and asset management.

DIFC is one of the world’s top ten onshore financial centers and offers a secure and efficient platform for businesses and financial institutions to reach into and out of the emerging markets of the region. The quality and independence of DIFC’s regulator, the prevailing common law framework, excellent infrastructure, and tax efficiencies make it the perfect base to take advantage of the rapidly growing demand for financial and business services in the MENASA region.

DIFC fills the time-zone gap for a global financial center between the leading financial centers of London and New York in the West and Hong Kong and Tokyo in the East.

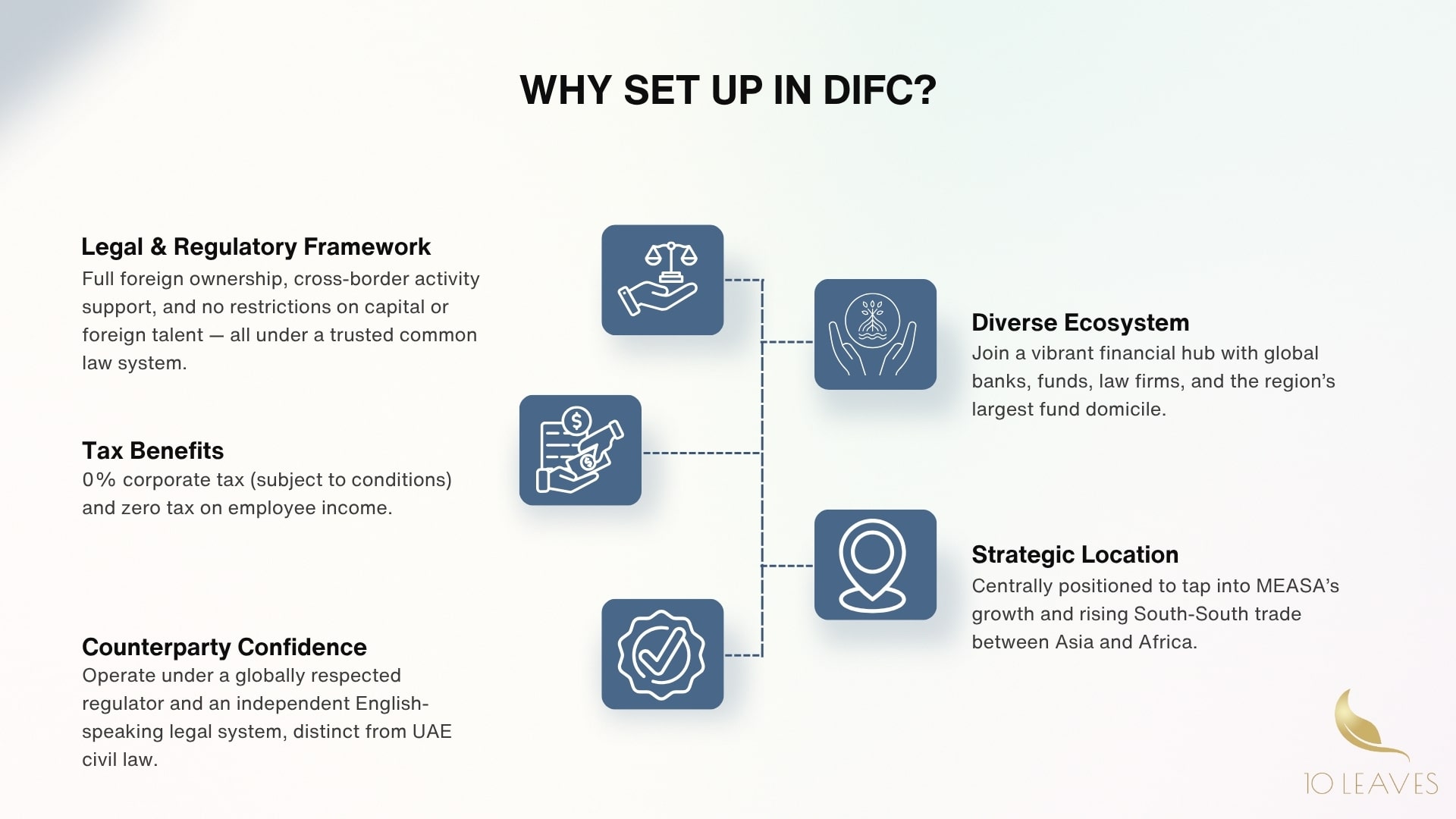

Why should you set up a financial services entity in the DIFC?

The DIFC stands as a premier financial center in the region, hosting over 400 wealth and asset management firms that collectively manage more than $750 billion in assets. This strategic location provides unparalleled access to the extensive private and sovereign capital available in the region.

Furthermore, the DIFC offers an advanced regulatory framework for digital assets, encompassing investment and crypto tokens. It also features a dedicated Innovation Hub, supporting companies in the fintech, AI, and blockchain sectors.

Recently, there has been a notable and continuous influx of High-Net-Worth Individuals (HNIs) into the UAE. Dubai alone is home to over 72,500 HNWIs and Ultra-High-Net-Worth Individuals (UHNWIs), whose combined wealth exceeds $500 billion. The broader Middle Eastern region boasts over $3.5 trillion in HNWIs wealth and more than $4.8 trillion in financial capital managed by 40 state-owned investors.

The DIFC is also witnessing high growth in the alternatives segment. It currently includes 70+ hedge funds, with over 45 of these managing over a billion dollars worldwide. As a result, the DIFC has emerged as one of the world's top ten locations for hedge funds, with ambitions to enter the top five in the near future.

The DIFC has been consistent in attracting family businesses as well, with over 850 familiy-owned businesses located in the centre, a growth of over 30% in 2024.

By the end of 2024, DIFC reported that the top 120 families and wealthy individuals in the community were managing over USD 1.2 trillion in wealth. The use of Foundations and associated structures also saw a 50+ percentage jump, reaching nearly 700 foundations by the end of 2024.

The Centre in the UAE is a cultural hub, featuring fine dining, retailers, and art galleries. Events like DIFC Art Nights and the Sculpture Park attract artists and enthusiasts. Art Dubai, backed by DIFC, remains the foremost global art event in the Middle East.

Specific Advantages

Here are some specific advantages of establishing in the Dubai International Financial Centre

LEGAL AND REGULATORY FRAMEWORK

- Legal framework supports cross-border activities.

- 100% foreign ownership permitted.

- No restriction on foreign talent or employees.

- No restrictions on capital repatriation.

TAX BENEFITS

- 0 percent corporate tax subject to certain qualifications.

- Zero tax on employee income.

COUNTERPARTY CONFIDENCE

- Highly regarded, independent regulator.

- Independent, English-speaking, common law judicial system.

- Distinct from the UAE legal system.

- Risk-based regulatory approach.

DIVERSE ECOSYSTEM

- Central to regional deal making.

- High concentration of international firms, investment funds, wealth management firms, banks, and financial institutions.

- World-class regional and international law and auditing firms, and other professional services.

- The largest fund domicile in the region.

GEOGRAPHIC EPICENTRE

- Management offices, holding companies and family offices are located closer to the assets they own or manage.

- The Middle East, Africa and South Asia (MEASA) is increasingly the centre of gravity for the global economy.

- Dubai plays a central role in the growing South-South trade, principally between Asia and Africa.

- Well-positioned to harness the potential of emerging markets.

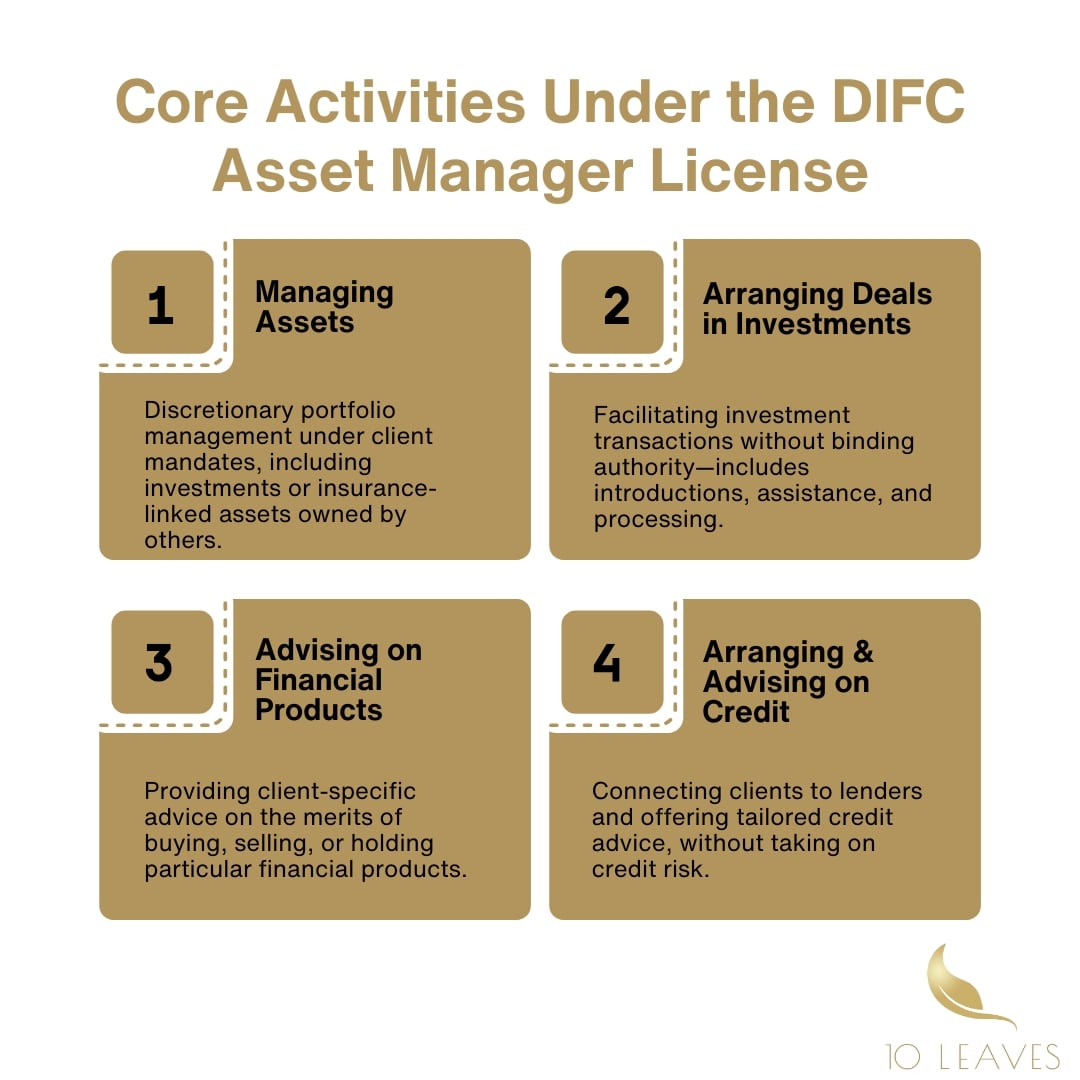

DIFC Asset Manager License

Firms engaging in the activity of ‘Asset Management’, can apply to the DFSA for a Cat 3C License. Asset management, in this context, means managing client portfolios on a discretionary basis, under a client mandate.

Firms interested in managing client assets from the DIFC are required to submit applications to the Dubai Financial Services Authority, or DFSA.

Asset Management activities are discretionary in nature, and can include:

Managing Assets

Discretionary management: The manager has the authority to make investment decisions on behalf of the client, within the mandate agreed upon.

Assets must include investments: The assets managed must include at least one investment or rights under a long-term insurance contract (excluding reinsurance).

Belonging to another person: The assets are owned by someone other than the manager.

Arranging Deals in Investments

Discretionary management: The manager has the authority to make investment decisions on behalf of the client, within the mandate agreed upon.

Assets must include investments: The assets managed must include at least one investment or rights under a long-term insurance contract (excluding reinsurance).

Belonging to another person: The assets are owned by someone other than the manager.

Advising on Financial Products

Giving a person specific advice about the merits of buying, selling, holding, or dealing in a particular financial product. This advice is tailored to the client and goes beyond just providing general information or facts.

Arranging Credit and Advising on Credit

1. Intermediation: It's about facilitating the connection between a potential borrower and a lender.

2. No Principal Risk: The arranger typically does not provide the credit themselves or take on the credit risk. Their role is to set up the deal.

3. Giving Recommendations: It's about providing opinions, recommendations, or specific advice tailored to the client's circumstances regarding credit products.

4. Merits of a Specific Product: The advice must relate to the advantages or disadvantages of a particular credit facility for the client.

5. Distinction from General Information: Simply providing general information about credit facilities, without specific recommendations or opinions on the merits for a particular client, would generally not be considered "Advising on Credit."

Firms that wish to engage in non-discretionary investment advice related activities, can opt for a DIFC Investment Advisory License instead. You can read more details here.

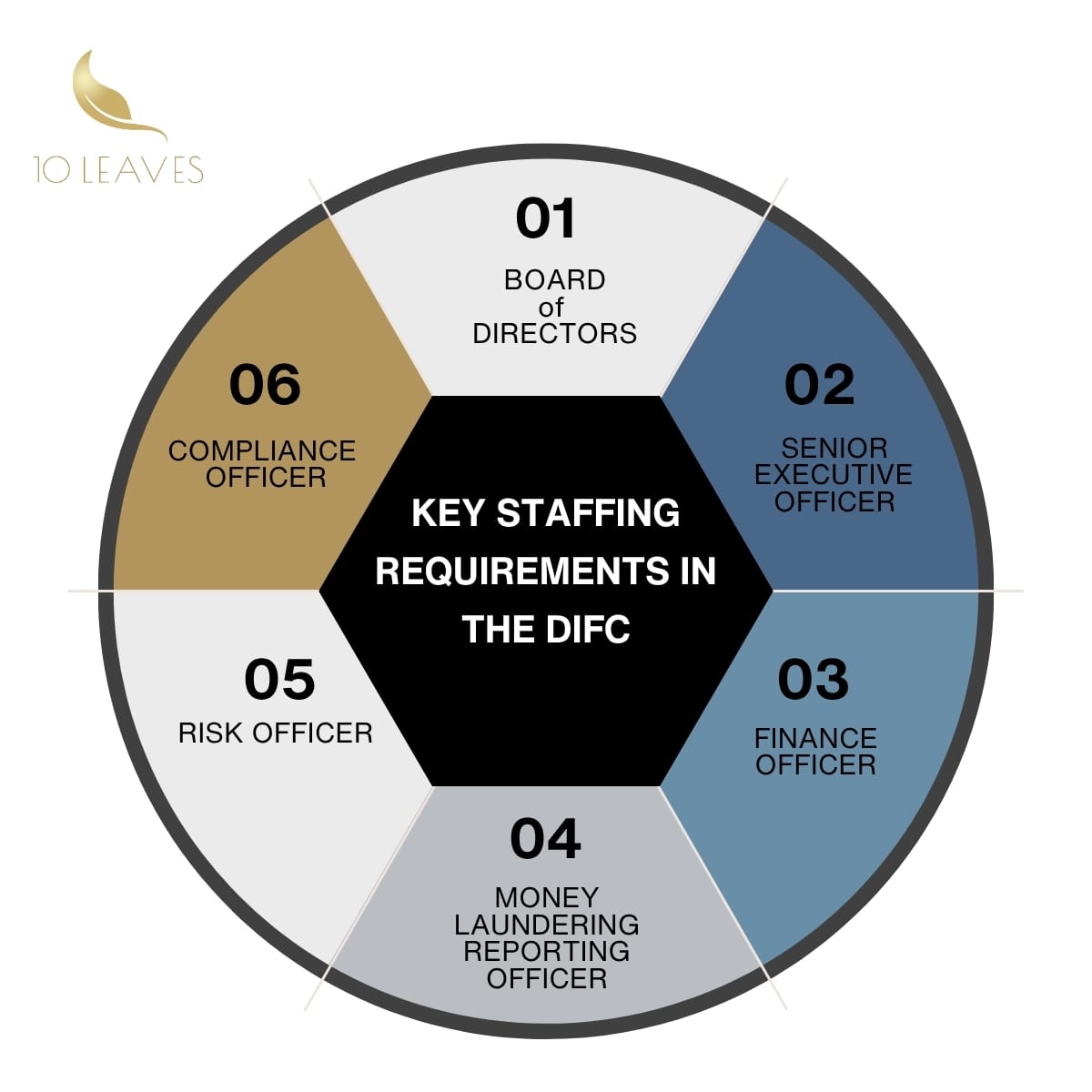

What are the key staffing requirements in the DIFC?

As with other category firms, the DFSA expects that the firm be adequately staffed depending on the scale, scope and nature of the product portfolio that is proposed to be offered from the DIFC.

At a minimum, the DFSA would like to see the following appointments:

1. Board of Directors – a well-organized, diverse Board with Non-Executive and/or Independent Directors and robust governance policies. The Chair would have to be a non-executive Director.

2. Senior Executive Officer (SEO) – Senior finance professional with over 10-15 years of core experience, ordinarily resident in the UAE.

3. Finance Officer (FO) – Senior and suitably-qualified finance professional. In case of a group, the FO can be from the parent company and does not have to be resident in the UAE.

4. Risk Officer – Senior risk professional, can be from the parent entity in case of a group.

5. Compliance Officer (CO) - Senior compliance professional with over 10 years of experience, ordinarily resident in the UAE.

6. Money-Laundering Reporting Officer – Senior AML professional with over 10 years of experience, ordinarily resident in the UAE. This function can be combined with Compliance and one individual can carry out both responsibilities.

7. The Finance Officer, Compliance Officer and Money Laundering Reporting Officer roles can also be outsourced to a competent service provider, such as 10 Leaves.

8. Internal Auditor - Senior and suitably qualified internal audit professional. Usually outsourced to a professional firm.

9. External Auditor - Senior and suitably qualified external audit firm. The DFSA maintains a list of recognised auditors, and there are 16 such firms at present.

DIFC Capital requirements

The base capital requirement for a Category 3C Asset Manager has now been dropped to US$ 140,000. Actual capital resources required will depend on the nature, quantum of business and forecasted annual expenditure, as per the financial model of the proposed firm.

Capital waivers may be available to the DIFC branch of a regulated financial institution having its head office in a recognized regulatory jurisdiction.

The DFSA lists out multiple ways of calculating capital, and specifies capital requirements for a firm as the highest of the Base Capital, Risk-Based capital and Expense-Based Capital.

These figures are calculated using the financial models that we make for the Regulatory Business Plan during the application process and so are mostly unique to the company that applies for the license.

The figures given below are for Base Capital only, and actual capital may vary depending on the business model and the associated expenses and risks.

In general, the Expense-Based Capital Requirement (EBCM) for Asset Management firms that hold Client Assets is calculated as 13/52 of the annual audited expenditure of the firm. Asset Managers that do not hold Client Assets are now exempted from the Expense- Based Capital Requirement.

Calculation of capital is a detailed process and involves many factors. We recommend that you contact us for more details on the application process and capital calculations.

Can DIFC firms service clients outside the centre, and in the greater UAE?

Yes, they can. Sheikh Mohammed bin Rashid Al Maktoum issued Law No. (5) of 2021 relating to the DIFC, which brought further clarity to the rules governing the promotion and supply of services and products for firms registered in the centre.

The revised law clarifies that DIFC-registered entities are permitted to provide services and products outside the DIFC, provided that the primary services are offered from within the DIFC area. Additionally, marketing and promotional activities are allowed outside the center.

There may be additional rules to follow, for instance, when actively marketing funds from the DIFC. A passporting regime exists in this case, where the fund manager can register for a passport for the fund to be marketed in the UAE and the ADGM. Do get in touch for more information on this.Can a DIFC-based Asset Manager manage or advise on Crypto Assets?

Yes, a DFSA-regulated Asset Manager can manage and advise on Crypto assets, provided that they are recognised Crypto Tokens. The DFSA has procedures for recognizing Crypto Tokens and maintains a list of such tokens. The current list of DFSA Recognised Crypto Tokens includes:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Toncoin (TON)

- XRP

- ZetaChain (ZETA)

- EURC

- USDC

- Ripple (RLUSD)

Update:

Advising, arranging or managing Virtual Assets

The Dubai Financial Services Authority (DFSA) recently issued a consultation paper on the regulation of Crypto Tokens in the DIFC. This paper is one of the two consultation papers that will go on to make the base for the DIFC Digital Assets Regime, thus opening the gateway to a whole new world of exciting and cutting-edge fintech applications using the Distributed Ledger Technology (DLT).

The first paper covered Security Tokens, and you can read the details here.

The DFSA then made the relevant amendments to it’s legislation in the end of September, thus creating the framework for the regulation of Security Tokens in the centre.

Part 2 of the DIFC Digital Assets Regime covers Crypto Tokens, Utility Tokens, Exchange Tokens and Stablecoins, and you can read more here.

Any licensed firm that wishes to advise, arrange or manage crypto-assets, will have to apply for additional endorsements to their licenses. Get in touch with us to know more.

What is the process for licensing an Asset Management License in the DIFC?

The DIFC application process commences with formal introductions to the DIFC and the DFSA.

Following the introductory call, a detailed Regulatory Business Plan (RBP) is prepared, along with financial projections, for a quick review by the regulator.

The comments of the regulator are incorporated into the RBP, and a comprehensive application is compiled, comprising policies, processes and other related documentation. The KYC and associated forms of all key individuals are also prepared for submissions.

The formal application is then sent across to the DFSA, who reviews the pack over a period of 15-20 business days, and then accepts it. The detailed review process then commences, and this can take anywhere between 60 and 90 days to complete.

The regulator maintains communication with the applicant at all times during the review, reverting with an initial review 2 weeks into the application, and then follow-up reviews thereafter. The DFSA also meets with the SEO, FO and CO/MLRO designates, and conducts a detailed interview with them.

A key milestone is the issuance of an In-Principle Approval, or IPA, which is issued once the application is successful. The applicant then proceeds to satisfy the in-principle conditions, and this involves the setting up of a legal structure, opening a bank account, and depositing the share capital in the account. Other tasks include finalisation of auditors and obtaining professional indemnity insurance for the firm.

Once done, a final submission is made to the DFSA, following which the regulator issues the Financial Service Permissions and the process is then complete. The firm is now open for business.

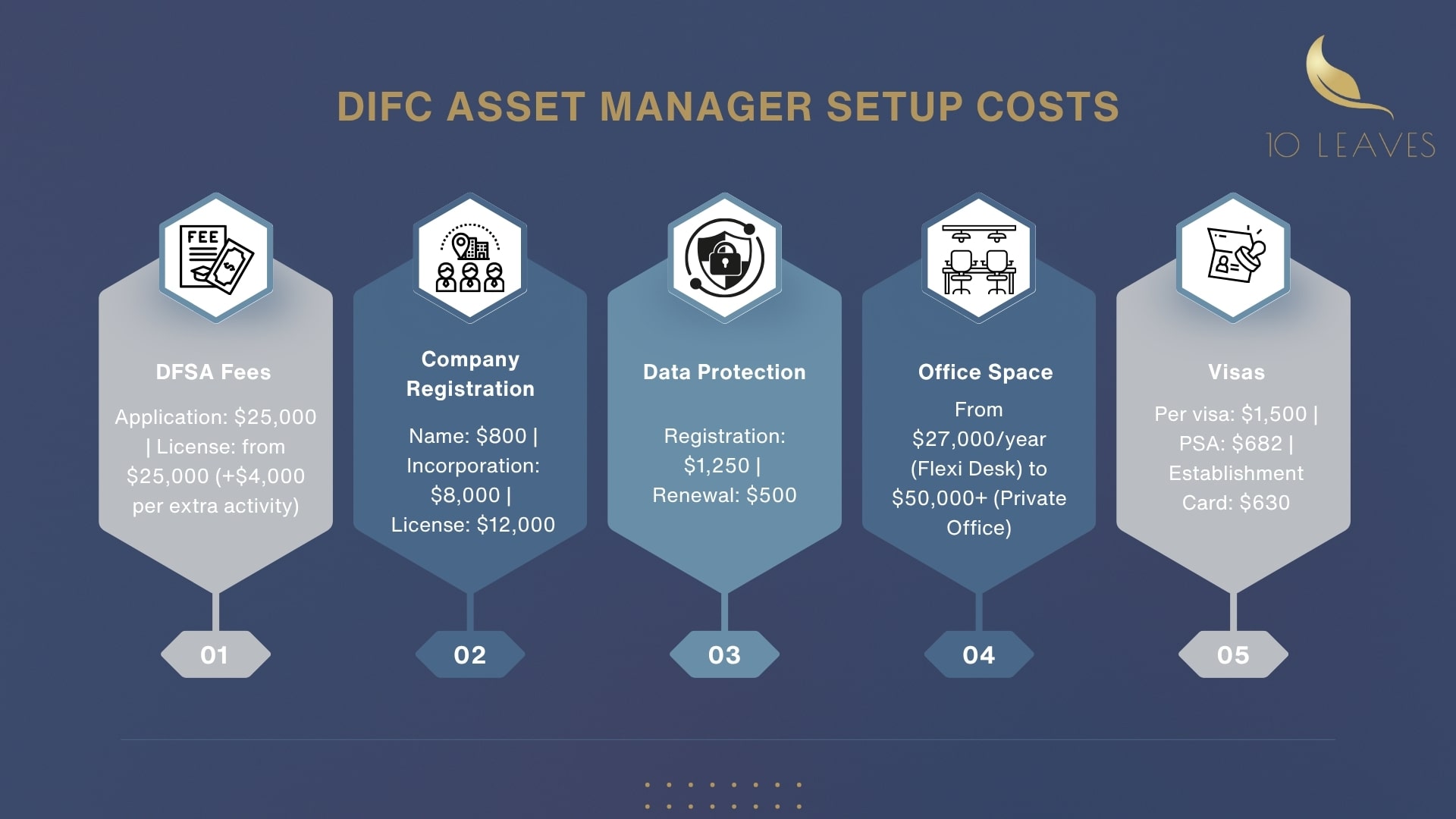

How much does it cost to setup an Asset Manager in the DIFC?

Setting up a DFSA Regulated Firm involves the following costs:

Dubai Financial Services Authority (DFSA)

The DFSA is responsible for reviewing and approving all applications for financial services. Costs depend on the activities applied for, which puts the applicant in one of five categories.

Generally, there are two components of DFSA fees. One – an application processing fee, and the other, an annual licensing fee.

(i.) Application fee: US$ 25,000 for an Asset Manager license application. The DFSA may charge an additional 100% fee for complex structures.

(ii.) License fee: from US$ 25,000 for an Asset Manager license application. From 2025, an additional US$ 4,000 is charged as an annual fee per additional activity.

Registrar of Companies (DIFC ROC)

The ROC helps to set up the legal structure of the DIFC Regulated Firm. Shareholders can be individual, or corporate. There are many options available, such as ‘Private Company Limited by Shares’ and ‘Limited Liability Partnerships’. In case of Private Company Limited by Shares, the costs for setting up include:

(i.) Application for reserving a name (2 working days): US$ 800.

(ii.) Application for Incorporation of a Private Company Limited by Shares (5 working days): US$ 8,000.

(iii.) Commercial License on Incorporation (5 working days): US$ 12,000 (annual fee).

Data Protection

The data protection notification is part of the process of registering a new entity in the DIFC. The costs involved are as follows:

(i.) Registration - US$ 1,250.

(ii.) Annual renewal – US$ 500.

Office spaces

Every entity registered in the DIFC is required to lease a physical office. You can choose from the Gate and surrounding buildings, or other buildings within the DIFC, such as Emirates Financial Towers, Central Park, Park Avenue, Burj Daman and Currency House.

Prices vary, depending on the space availed and the building. Here is an indication of the prevailing rates:

1. New DIFC Funds Centre – US$ 27,000 per annum for a Flexi Desk, US$ 42,000 per annum for a fixed desk and approximately US$ 50,000 per annum for a 2-desk private office.

2. DIFC Business Centre – from a one-desk office at US$ 30,000.

3. DIFC Fitted Offices – from US$ 55 per square foot.

4. Other buildings – from US$ 50,000 per annum.

Visas

1. Establishment Card Application – US$ 630.

2. PSA Deposit – US$ 682.

3. Visas (per visa) – from US$ 1,500.

4. PSA Deposit (per visa) – US$ 682.

Our Services

How can we at 10 Leaves assist you?

We provide turnkey services for DIFC Category 3C Asset Manager Licenses. From initial consultations to assistance in authorisations, to assistance in preparation of the legal documentation, 10 Leaves helps you navigate the DFSA Rulebook and submit an application that is comprehensive, complete and compliant.

Our services include assistance in:

Pre-Licensing

- Reviewing the business model and advice on the applicable regulatory framework;

- Preparation of the Regulatory Business Plan and comprehensive financial projections;

- Preparation of all policies, processes and manuals required;

- Provision of Outsourced services, including outsourced Compliance Officer, outsourced Finance Officer and outsourced Risk Officer services;

- Assistance in recruitment of senior management;

- Provision of well-qualified and experienced Non-Executive Directors;

- Finalising the legal structure, including holding company setup and customisation of Memorandums; and

- Finalisation of leased space, bank account opening and obtaining Financial Services Permissions.

Post-Licensing

- Compliance, Finance and Risk outsourced and support services.

- VAT and Corporate Tax services.

- Secretarial services.

- Variation of Permissions.

- Compliance remedial measures.

- Compliance audits.

- Training.

- Senior-level recruitment services.

Our solution focuses on comprehensive training for Directors, Senior Executive Officers, Finance Officers, and Compliance Officers. We equip them with the knowledge and skills needed to successfully clear interviews conducted by the DFSA during the authorization process and for ongoing compliance.

A lot of our Category 3C clients are startups, where experienced investment bankers set up their own shop. In these cases, we also assist such teams with corporate and commercial documentation through our legal consultancy - 10 Leaves Legability. We assist in the drafting of:

- Founder agreements.

- Shareholder agreements.

- Investor agreements.

- Share vesting/ESOP plans.

- Client/Supplier/Distributor agreements.

- Employment agreements.

We also provide services in Luxembourg, Saudi Arabia, India and Mauritius.

Get in touch today! to know more about DIFC Asset Manager License.

CONTACT

CONTACT